Meta’s $30 billion debt-financed deal for a gigantic AI data center in Louisiana is an instance of how “the panorama has out of the blue gotten rather a lot, lot, lot extra difficult” for tech shares going ahead, Morgan Stanley Chief Funding Officer, Wealth Administration, Lisa Shalett advised Fortune.

The Meta settlement is the most important personal debt deal ever, according to The Wall Street Journal. Eighty % of the Hyperion information heart in Richland Parish, Louisiana, shall be owned by Blue Owl Capital, with Meta retaining solely a 20% stake. The location will technically be owned by a special-purpose automobile, and thus won’t seem on Meta’s steadiness sheet. Morgan Stanley was the bookrunner that put the deal collectively, according to Bloomberg.

The deal is a departure from the best way AI has been funded up to now, Shalett mentioned. Beforehand, funding got here immediately from the money on massive tech corporations’ steadiness sheets. Now, with off-balance sheet debt within the image, corporations will come below elevated strain to point out a return on their investments, she mentioned.

“Within the first part, within the first three years, Zuckerberg was constructing all the pieces with money on his steadiness sheet, with free money circulate,” Shalett mentioned, referring to Meta founder Mark Zuckerberg. “Once you begin utilizing debt, and you employ debt within the shadow banking market, that means you’re partnering with private-credit gamers the place you’re utilizing personal wealth cash, and so on, and so on, it simply will get tougher to trace, and it will get increasingly unwieldy, and that creates strain to truly earn that return on funding.”

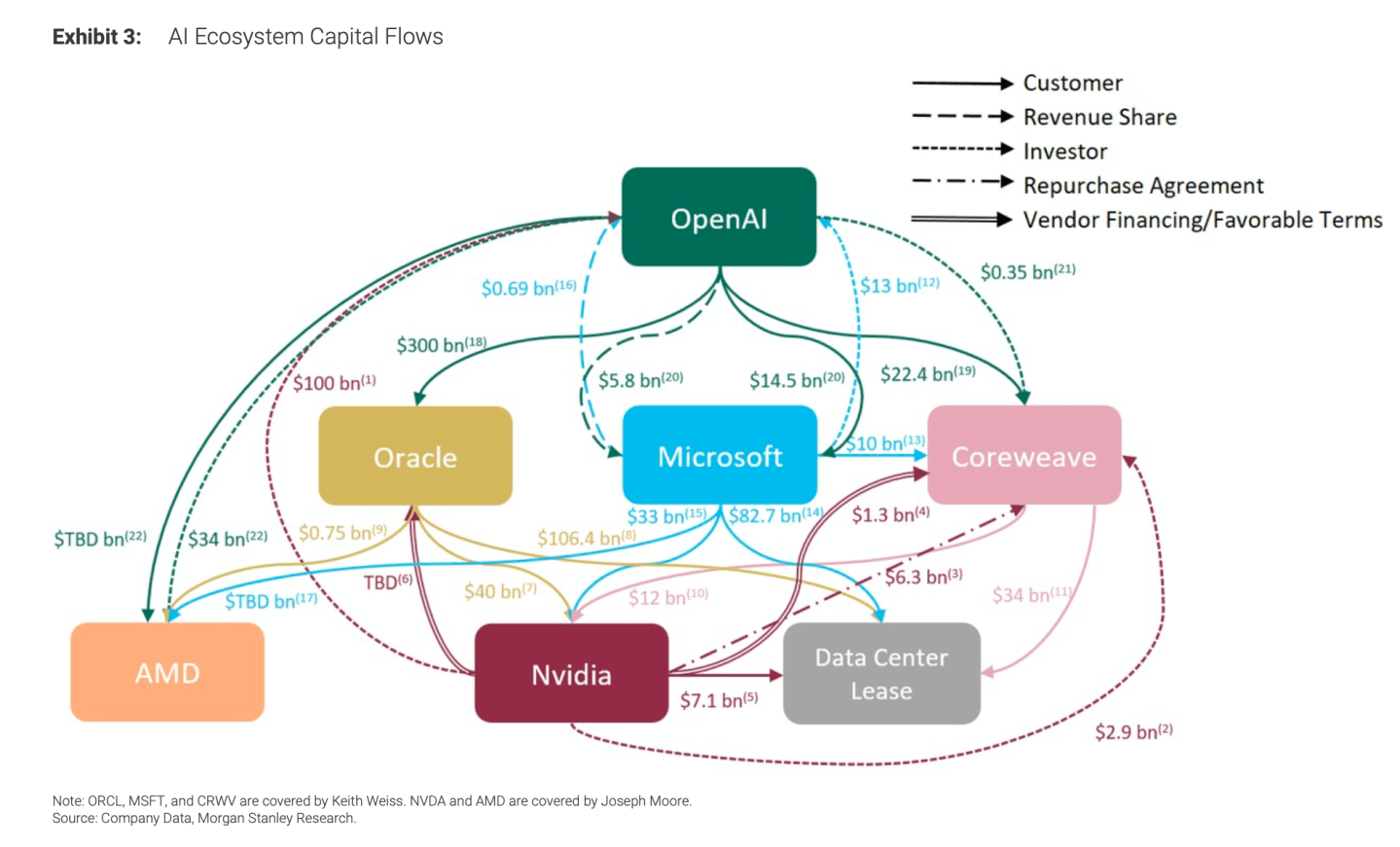

Shalett additionally expressed some scepticism concerning the excessive degree of interconnectedness between AI corporations and their distributors. Earlier this month, Morgan Stanley analyst Todd Castagno and his workforce produced a diagram of what he known as the “more and more round” AI ecosystem:

“Within the final 30, 60, 90 days, the panorama has out of the blue gotten rather a lot, lot, lot, extra difficult,” Shalett mentioned. “The offers and the cross-dealing have gotten increasingly and extra difficult, the place a few of this begins to look and feel and scent like round dealing, like vendor financing. And I say this not as a result of I believe anybody is doing something nefarious. I don’t. However what I’m seeing is what was a quite simple story is out of the blue getting much more advanced.”

Nonetheless, Shalett believes shares will “grind greater … however we don’t suppose it’s going to be this re-accelerating growth.”

Alongside the best way she warned merchants to be careful for an “accident” in AI. For example, “the accident may very well be that someway OpenAI doesn’t really develop a real income mannequin to pay for all this capability that they’ve dedicated to purchase from all people,” she mentioned.

In that case, a 10-20% correction within the S&P 500 is perhaps on the playing cards, she mentioned.

“Is [generative] AI not finally going to repay? It most likely will finally repay. However the path won’t be a straight line,” she mentioned. “We’re not attempting to beat up on the story. We’re not attempting to say, ‘we’re getting into a bear market,’ any of that. We predict that this has legs however we expect that the legs are getting weaker and weaker and weaker as the times go by.”

Meta and OpenAI have been each contacted for remark.

Right here’s a snapshot of the markets forward of the opening bell in New York this morning:

- S&P 500 futures up 0.62% this morning. The final session closed up 0.58%.

- STOXX Europe 600 was flat in early buying and selling.

- The U.Okay.’s FTSE 100 was flat in early buying and selling.

- Japan’s Nikkei 225 was up 1.35%.

- China’s CSI 300 was up 1.13%.

- The South Korea KOSPI was up 2.5%.

- India’s NIFTY 50 was up 0.08%.

- Bitcoin is up at $111K.