The U.S. economic system remains to be managing to keep away from a recession, however simply barely, with its destiny probably resting on California and New York, in line with Moody’s Analytics chief economist Mark Zandi.

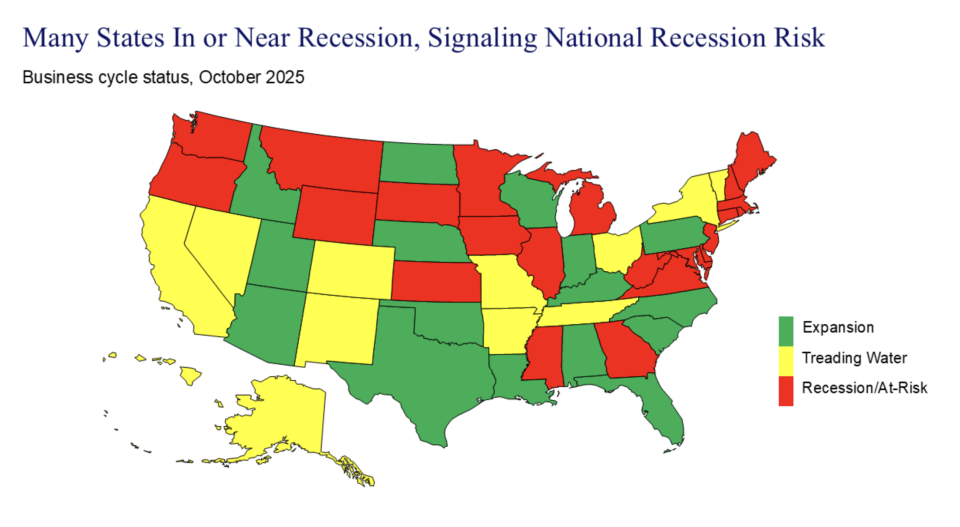

In social media posts on Wednesday, he reiterated his warning that states representing practically one-third of nationwide GDP are already in a recession or at excessive danger of 1. One other third is “treading water,” whereas the remaining are nonetheless rising however affected by much less momentum.

Whereas his newest evaluation largely echoes what he said over the summer and earlier this month, Zandi moved the commercial bellwether state of Michigan from the “treading water” record to the “recessionary” one.

That’s as President Donald Trump’s tariffs proceed to weigh on the automakers that energy the state’s economic system. Whereas General Motors and Ford reported upbeat third-quarter earnings this previous week, they nonetheless see billions of {dollars} in tariff-related prices.

In the meantime, supply-chain disruptions—together with China’s curbs on rare-earth exports that got here in retaliation to Trump’s commerce warfare—have additionally hit manufacturing.

“This state-level image mirrors the nationwide development: the U.S. economic system will not be in recession, however it’s struggling to keep away from one,” Zandi wrote. “That is evident within the job market, as payroll job development has come to a digital standstill, and sure will look even weaker in any case the information revisions are in.”

Building, manufacturing, expertise, finance, authorities, {and professional} companies are shedding jobs, he added, whereas just some sectors, particularly healthcare and hospitality, are nonetheless including to payrolls.

Earlier this month, he sounded the alarm on the labor market, saying it’s weak and getting weaker as private-sector datasets point out there was basically no job development in September.

Right here’s how the states and one federal district(*) break down:

- Recession/excessive danger (23): Wyoming, Montana, Minnesota, Mississippi, Kansas, Massachusetts, Washington, Georgia, New Hampshire, Maryland, Rhode Island, Illinois, Delaware, Virginia, Oregon, Connecticut, South Dakota, New Jersey, Maine, lowa, West Virginia, Michigan, District of Columbia*.

- Treading water (12): Missouri, Ohio, Hawaii, New Mexico, Alaska, New York, Vermont, Arkansas, California, Tennessee, Nevada, Colorado.

- Increasing (16): South Carolina, Idaho, Texas, Oklahoma, North Carolina, Alabama, Kentucky, Florida, Nebraska, Indiana, Louisiana, North Dakota, Arizona, Pennsylvania, Utah, Wisconsin.

Moody’s Analytics

For now, financial heavyweights California and New York are treading water however might simply tip the scales. The Golden State alone accounts for a whopping 14.5% share of U.S. GDP, whereas the Empire State accounts for practically 8%.

Each face opposing crosscurrents which will in the end decide how the enterprise cycle unfolds, Zandi identified.

“Whether or not the nationwide economic system suffers a downturn seems to relaxation on the large California and New York economies. Neither economic system is in recession, however each are struggling to achieve traction,” he defined. “De-globalization, together with the commerce warfare and extremely restrictive immigration coverage, is a headwind to development, however synthetic intelligence and the enhance it’s offering to funding and the inventory market, family wealth, and spending is a tailwind to development.”

To make sure, the general economic system has been increasing at a sturdy clip. The Atlanta Fed’s GDP tracker reveals third-quarter development is pointing towards 3.9%, which might really mark an acceleration from 3.8% development within the second quarter.

On the similar time, most state-level information nonetheless doesn’t counsel a spike in layoffs, persevering with a no-fire, no-hire atmosphere.

And whereas the federal government shutdown has put a number of key financial indicators on maintain, the Labor Division launched the consumer price index for September, which ticked larger however got here in beneath forecasts.

That raised the percentages for extra fee cuts from the Federal Reserve later this 12 months, delivering one other enhance to the economic system.

However Diane Swonk, chief economist at KPMG, warned Friday that the economy looks better than it feels and famous inflation remains to be creeping larger, albeit at a slower-than-expected tempo.

She expects the economic system to sluggish “dramatically” within the fourth quarter, a flip that was already coming earlier than the shutdown drained 750,000 federal paychecks from the economic system. Shopper stress, rising delinquencies, and tariff pass-throughs will all collide with a fragile labor market and weaker retail panorama.

“We’re going into a really tough vacation season,” Swonk predicted.