Warner Bros. Discovery introduced Tuesday it has initiated a complete evaluate of strategic options, Wall Road-speak for contemplating a sale course of, as rumors have swirled for months that one among Hollywood’s legacy studios might be acquired. The corporate disclosed in a press release that it had obtained “unsolicited curiosity from a number of events for your complete firm” and for its iconic Warner Bros. section. Paramount Global, itself not too long ago acquired by David Ellison, the son of Trump ally Larry Ellison, reportedly made a $20-per-share bid earlier this month. Netflix, the dominant streamer turned Hollywood energy participant, has additionally been rumored as a possible acquirer, though co-CEO Greg Peters downplayed it earlier this month and it’s not referred to as an energetic M&A participant.

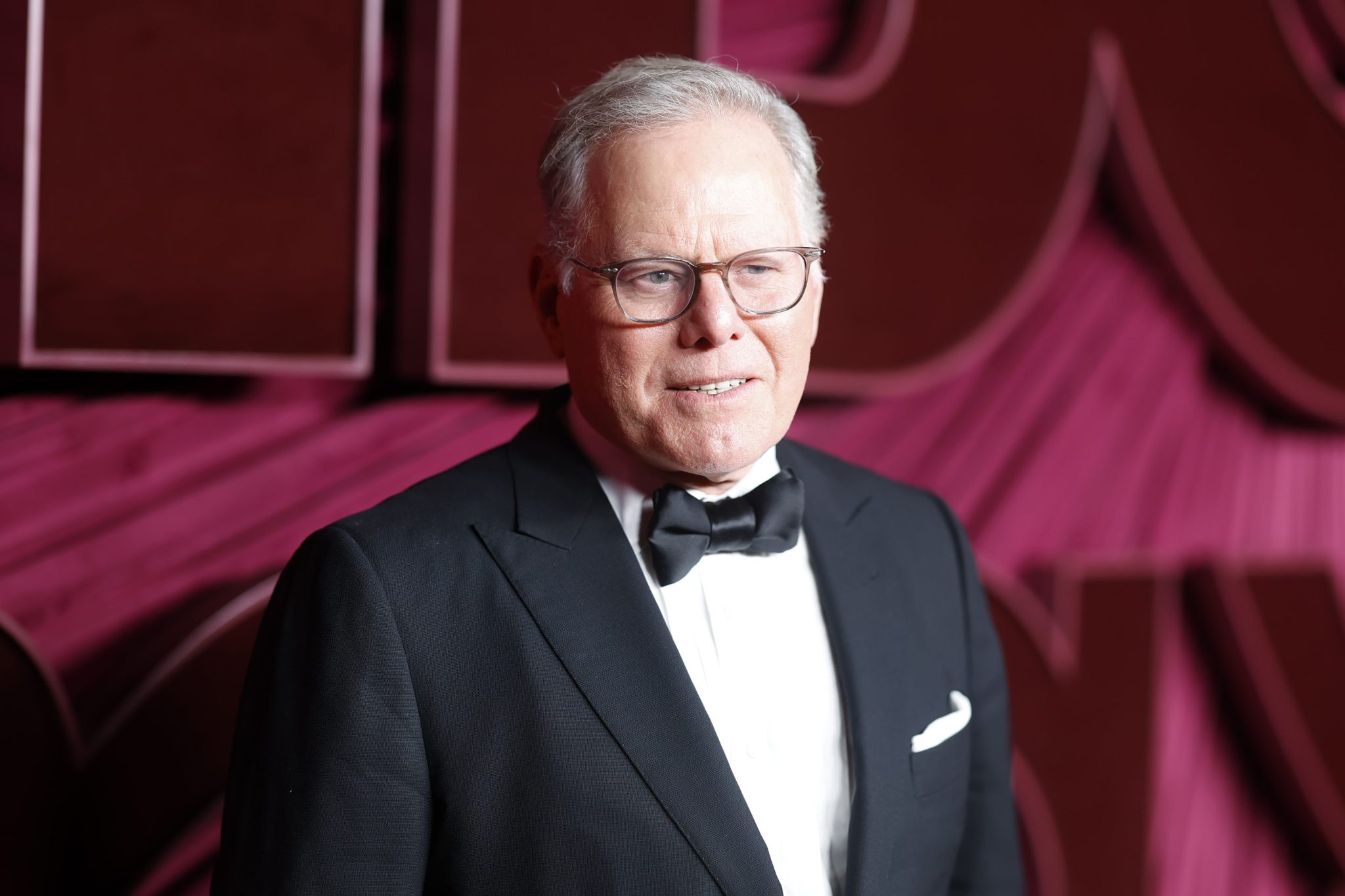

“It’s no shock that the numerous worth of our portfolio is receiving elevated recognition by others available in the market,” CEO David Zaslav mentioned within the press launch. “After receiving curiosity from a number of events, we’ve got initiated a complete evaluate of strategic options to establish the very best path ahead to unlock the complete worth of our belongings.”

Board Response to Provides

The corporate’s Board of Administrators confirmed the evaluate is happening not solely to proceed with the beforehand outlined separation, however to contemplate a variety of transactions. These embrace an outright sale of Warner Bros. Discovery as a complete, promoting off separate divisions, or exploring frameworks for mergers and spin-offs that will maximize shareholder worth.

The announcement comes amid a quickly altering media panorama, the place the worth of content material libraries, studios, and world distribution platforms has soared. Warner Bros. Discovery had already been making ready to divide operations to raised place itself in streaming, movie, and tv markets. This course of was anticipated to culminate by mid-2026 however is now joined by severe exterior curiosity, which might speed up or reshape the corporate’s plans. Any acquisition—whether full or partial—would represent one of the biggest shake-ups in Hollywood history, given Warner Bros.’s vast portfolio, which spans HBO, DC Studios, CNN, Discovery Channel, and extra.

Market Reaction and Implications

Investor response was instantaneous: Warner Bros. Discovery inventory surged by over 11% after the information broke, as merchants started to cost in the potential for a blockbuster deal. The timing of Warner Bros. Discovery’s announcement comes as tech titans and Hollywood moguls make aggressive moves. Most notably, Larry Ellison—Oracle CEO and not too long ago the world’s richest man—has positioned his household as media energy brokers, together with his son David Ellison main Paramount’s transformation.

David Ellison laid out a imaginative and prescient in July 2024 of Paramount changing into a “tech hybrid” that will in the future be able to competing with Netflix. Ellison has employed away former topline Netflix talent for Paramount within the type of programming chief Cindy Holland and he’s poached the creators of the “Stranger Issues” smash, the Duffer brothers.

For this story, Fortune used generative AI to assist with an preliminary draft. An editor verified the accuracy of the data earlier than publishing.